Dr. Areef Suleman is Director of Economic Research and Statistics at the Islamic Development Bank (IsDB) Institute. The views expressed in this essay are those of the author and do not imply or reflect the views of the IsDB Institute or IsDB Group

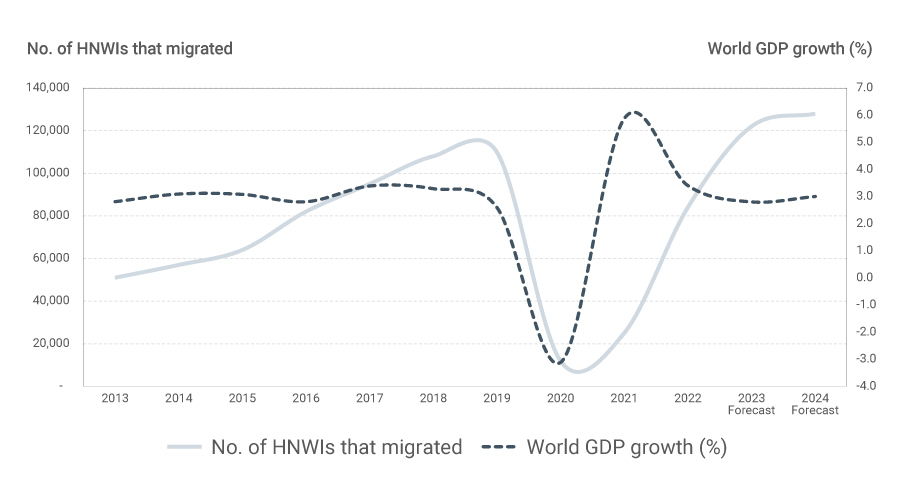

The number of high-net-worth individuals (HNWIs) that migrated globally has risen steadily since 2013, only to be interrupted by the Covid-19 pandemic in 2020.1 Mobility restrictions and the suspension of several immigration pathways at the height of the pandemic caused HNWI migration to plunge to around 12,000 individuals in 2020 from 110,000 in 2019, based on New World Wealth’s data. However, beginning in 2022, HNWIs appear to be on the move again.

Figure 1. Number of HNWIs that Migrate Globally compared to World GDP Growth

Sources: New World Wealth, 2023; World Bank 2013–2021 GDP Data; International Monetary Fund 2022–2024 GDP Growth Forecast.

Gross domestic product (GDP) growth in the post-crisis world is forecast to slow from 2022 onward, with growth stagnating to around 3% amid the headwinds faced by the global economy (Figure 1). Notwithstanding the dismal outlook for the global economy, New World Wealth forecasts HNWI migration to recover this year and further rise next year, with about 122,000 and 128,000 HNWIs expected to move in 2023 and 2024, respectively.

This is no surprise, as wealth migration is not driven by the health of the global economy per se but jointly motivated by unfavorable conditions in source countries and favorable conditions in destination countries. In the post-crisis world, when vulnerable countries are at a recovery disadvantage, we may expect an influx of HNWIs moving to more stable countries where their investable wealth faces less risk of losses.

Figure 2. Net Inflows and Net Outflows of HNWIs

Source: New World Wealth, 2023

Figure 2 shows that the top destinations in terms of forecast net inflows of HNWIs in 2022 and 2023 are the relatively more stable countries, characterized by comparatively stronger institutions and better-functioning markets. These include Australia, the UAE, Singapore, the USA, Switzerland, Canada, Greece, France, Portugal, and New Zealand.

Interestingly, the USA and Switzerland remain among the top destinations for net inflows of HNWIs, notwithstanding the recent banking failures. This could be because of their regulators’ swift and decisive actions, which a number of HNWIs continue to take as good signals of the strength of governance in these countries. It should be noted, however, that while net flows of HNWIs in the two countries continue to be positive, their net inflows are declining, which suggests that the recent crises in these countries are affecting HNWI flows to an extent. Switzerland’s net HNWI inflow is forecast to decline by 55% in 2023 from its 2019 peak, while the USA’s is forecast to drop by 81% from its high point, which was also in 2019.

Large outflows of HNWIs are forecast in countries with low or uncertain growth prospects because of unstable economic or geopolitical conditions. The countries with the biggest net outflows of HNWIs are China, India, the UK, and the Russian Federation.

Economic theory suggests that free inter-country mobility will move labor and capital from less to more productive destinations, holding other things constant. Individuals with expertise migrate to find where to use their labor best, while those with wealth seek opportunities to invest their capital.

In the post-crisis world, however, this may not be the only driving force of the global reallocation of labor and capital. Safety and stability are equally sought, especially when risk and uncertainty remain high. As such, we may see the movement of HNWIs mirroring capital reversals from emerging markets and developing economies to advanced economies, as is observable in Figure 2.

What can this mean for individual economies? The impact of migration — wealth migration, in particular — cannot be quantified by the sheer amount of investment itself. If Country A (destination country) received USD 1 million from HNWIs from Country B (source country), we could not say that Country A gained USD 1 million and Country B lost the same amount.

The impact of HNWI migration on destination countries will likely be beyond the investment itself because of a multiplier effect. If the USD 1 million coming from HNWIs are invested in a business, it could generate employment and additional demand from existing domestic producers, which multiplies its impact to an amount greater than the initial investment.

Meanwhile, for source countries, the opportunity lost is mitigated by the flow of remittances and international connections in the form of trade, foreign direct investments (FDIs), and technological transfers from destination countries.2

The impact of HNWI migration on the global economy while positive is not expected to be substantial given the scale of world output. In the same way, in larger economies such as the USA, the impact of investments from HNWIs is likely to contribute little to GDP.

However, in smaller economies such as Malta and Mauritius — each expected to see net inflows of 200 HNWIs in 2023 — the impact of HNWI investments can constitute a significant amount of GDP, which could be good for their post-crisis growth.

HNWIs will continue to be on the move so long as favorable opportunities exist across borders. In the short term, we can reasonably expect these opportunities to be present in countries that offer stability in the uncertain global landscape. The recovery pathways of individual economies in the post-crisis world will decide the flows of HNWIs in the next few years.

In the medium to long term, wealth migration, regardless of the direction of flows, could enhance cooperation between source and destination countries because of deepening global connections through trade, remittances, and FDIs. Such enhancement in global cooperation will be critical in weathering future shocks to the global economy.

Notes

1 ‘High-net-worth individuals’ or ‘HNWIs’ refer to individuals with an investable wealth of USD 1 million or more.

2 From the findings of the IMF working paper “The Impact of International Migration on Inclusive Growth: A Review” prepared by Zsoka Koczan, Giovanni Peri, Magali Pinat, and Dmitriy Rozhkov, retrieved from mf.org/en/Publications/WP/Issues/2021/03/19/The-Impact-of-International-Migration-on-Inclusive-Growth-A-Review-50169 on 10 May 2023.